Is a Housing Market Crash Imminent in 2024? Insights and Projections

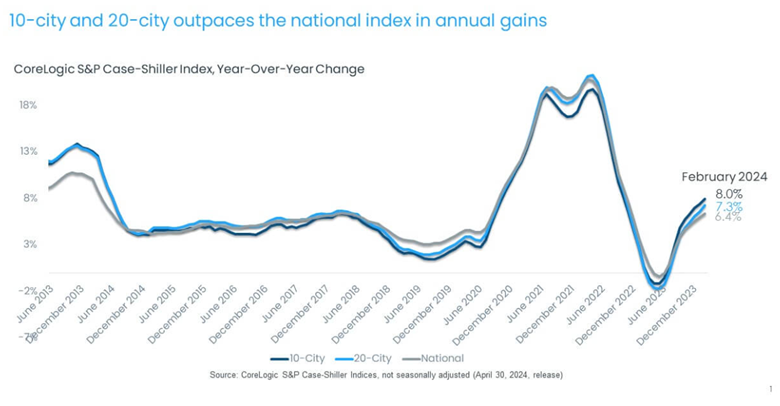

In the face of ongoing debates about an impending housing market downturn, the real estate sector has defied expectations by demonstrating resilience and growth into 2024. A surprising uptick in February saw home prices rise by 0.6%, a movement contrary to the usual seasonal slowdown historically seen during this month. The consistent upward trend is further evidenced by the CoreLogic S&P Case-Shiller Index, which notched a 6.4% increase year-over-year, marking its eighth straight month of gains. This positive momentum signals a robust beginning to the year, with prices reaching 1.3% above the June 2022 peak.

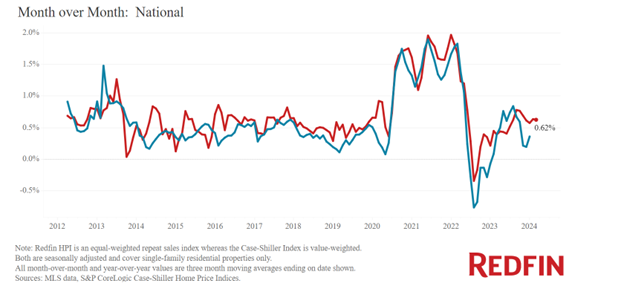

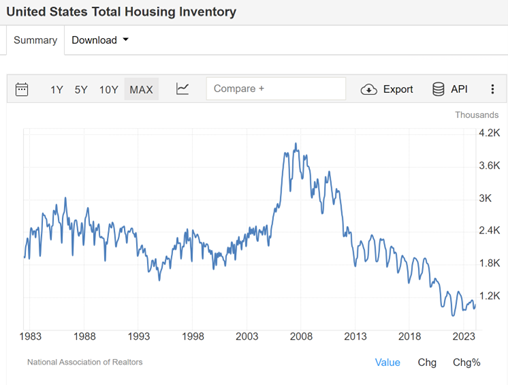

March also reflected this trend, as RedFin's Home Price Index recorded a similar 0.62% increase, suggesting the first quarter of 2024 outperformed predictions. The buoyancy of the housing market is largely attributed to the substantial demand from Millennials, now rivaling the Baby Boom generation in size, and the record-low inventory levels—down from two million homes in the 1980s to approximately one million today.

The enduring question of when a housing crash might occur seems to be answered by the basic principles of supply and demand. Despite attractive home value increases for property owners, the current high mortgage rates challenge affordability for many would-be homeowners. Nevertheless, the market shows signs of adjustment, with new listings and pending home sales experiencing growth in several regions.

Implications for Homeowners and Prospective Buyers

For those owning or looking to buy property, this market landscape presents both challenges and opportunities. Homeowners stand to gain substantial equity, potentially using it to re-invest in the market or as financial leverage. Buyers, on the other hand, must approach the market with strategic foresight, possibly considering mortgage rate buydowns to alleviate payment concerns.

Strategizing Equity for Homeowners

Homeowners are advised to formulate an equity transition plan, a strategy to harness their home's equity growth optimally. This could involve upgrading, downsizing, or exploring a reverse mortgage for financial flexibility without the burden of monthly payments. Consulting with a mortgage advisor can provide insights into navigating this market terrain effectively, avoiding the common trap of applying all home equity towards a new purchase's down payment.

Instead, a more nuanced approach involves utilizing portions of your equity to clear other debts, like car loans or credit card balances. This method aims to lessen overall household debt, making home acquisition more attainable even at higher interest rates.

The strategic use of equity and management of household debt is imperative in today’s real estate environment for enhancing financial agility and homeownership affordability. Contact us if you'd like to start a discussion.

All Rights Reserved | Luminate Bank | NMLS#1281698 | Privacy Policy | Company Licenses | NMLS Consumer Access Mortgage Banking Products are not FDIC Insured