Navigating Market Changes: Housing Forecast as We Enter a New Administration

Navigating Market Changes: Housing Forecast as We Enter a New Administration

As we look ahead, it’s clear: the housing market isn’t about to sit still. With new policies expected from the incoming administration, both homeowners and buyers will likely face fluctuations. Let's dive into how these changes may impact the market and discuss ways you can prepare in an evolving environment.

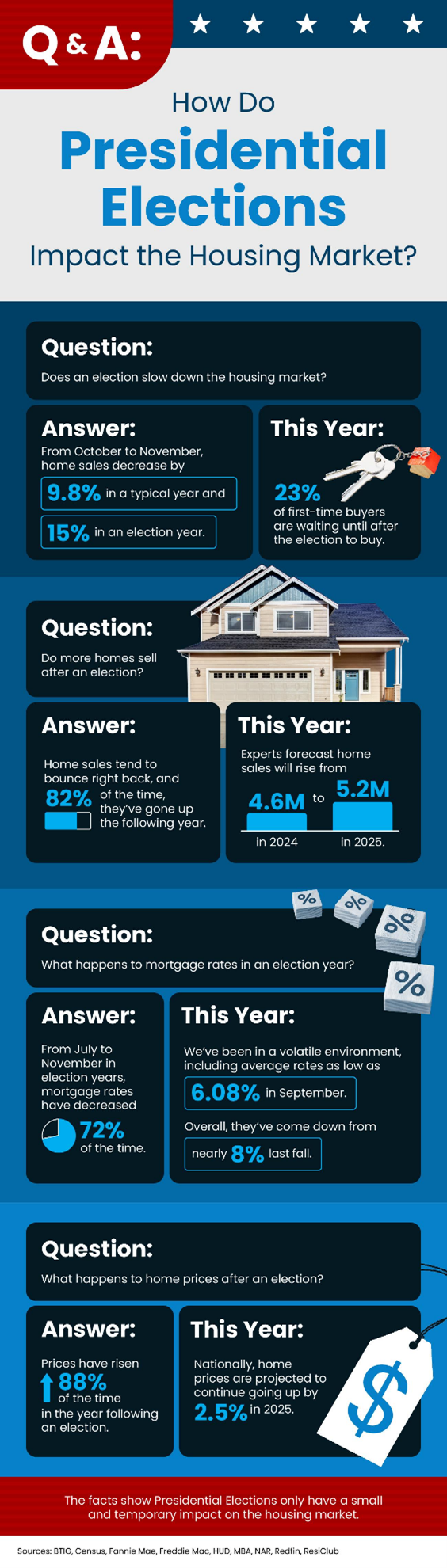

Post-Election Market Outlook

Historically, real estate tends to steady itself post-election, largely fueled by demand, rates, and inventory rather than political shifts. However, with a "red sweep" taking place, potential policy shifts could either anchor the market or add to current unpredictability.

Forecasting Volatility

Analysts foresee volatility as policy adjustments get underway. With the recent return of President Trump,

we’ve already seen the 10-year Treasury yield rise, pushing the 30-year fixed mortgage rate above 7%. Changes in administration often create ripples, and with new policies affecting inflation, rates, and economic stability, housing affordability remains top of mind.

Ken Johnson, a finance professor and real estate expert, notes that both parties' proposals haven’t yet fully addressed the core housing crisis. He remarks, “While proposals are often well-meaning, we’re still dealing with a severe housing shortage that’s driven prices sky-high.” The shortage, estimated between 2.5 to 7.2 million homes, is the crux of today’s affordability challenges, further stressed by regulatory and geographic limits.

Although efforts like reduced building regulations aim to boost supply, proposed tariffs and other restrictions could limit these effects. Economists caution that a more holistic approach is necessary to truly address housing availability and affordability.

Market Factors to Monitor

1.

Federal Reserve's Rate Decisions

The Federal Reserve’s stance on interest rates will shape much of the housing landscape. With inflation remaining a concern, rates could stay elevated, impacting affordability as we enter the new year.

2.

Inflation and Policy Dynamics

Combatting inflation will be a key focus. While strategies such as deregulation or incentives aim to stimulate growth, balancing this with inflation control may create some ups and downs for housing costs. Tariffs and immigration adjustments could also impact prices, adding further unpredictability.

3.

Supply and Demand Adjustments

With plans to make limited federal land available for development, the new administration intends to address supply issues. If successful, these policies could help first-time buyers, but the impact may be delayed. The administration's stance on immigration is also expected to play a role, potentially adjusting demand over time.

Preparing for the Road Ahead

Changes in rates, policies, and affordability are likely. The Michael Creed Team is here to keep you informed and guide you through the complexities of today’s market. Whether you're exploring a new purchase or considering refinancing, understanding how these changes affect your situation is crucial.

While the future may hold some unknowns, we can help you make sound, sustainable choices. If you’re thinking about buying or refinancing, reach out. Our team is ready to navigate you through these shifts and support your goals—no matter what the future brings.

All Rights Reserved | Luminate Bank | NMLS#1281698 | Privacy Policy | Company Licenses | NMLS Consumer Access Mortgage Banking Products are not FDIC Insured