Benefits of Homeownership in Today's Economic Climate

Overcoming Marking Fears

Navigating mortgage rates surpassing the 7% mark can be daunting for potential homebuyers. However, with a well-strategized approach, particularly in the Brookfield, WI, and greater Wisconsin area, this seemingly challenging market can present unique opportunities, especially for first-time buyers, physicians, doctors, those going through a divorce, and families looking into multigenerational housing.

Historical Perspective on Mortgage Rates

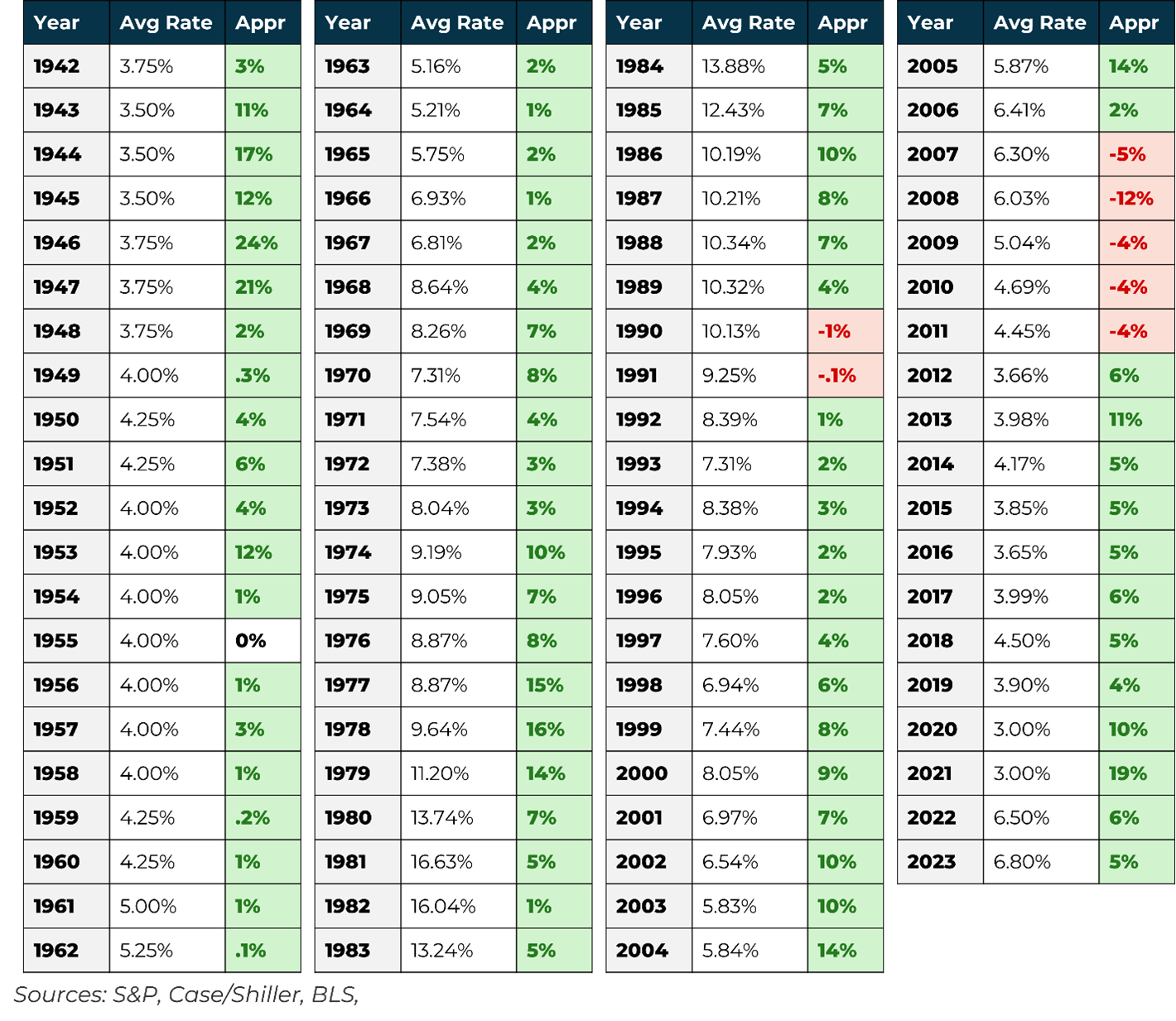

While current rates hovering around 7% might seem intimidating, understanding the historical context sheds light on the broader picture. In the early 1980s, mortgage rates soared to an eye-watering 18%, and even in more stable times, fluctuated above 10%. This historical perspective is crucial; it shows that today's rates, while higher than recent years, are within a historical norm. For first-time buyers and physicians in Brookfield, WI, understanding this context can help set realistic expectations and reduce anxiety over current rates.

Impact of Job Growth on Housing Demand and Prices

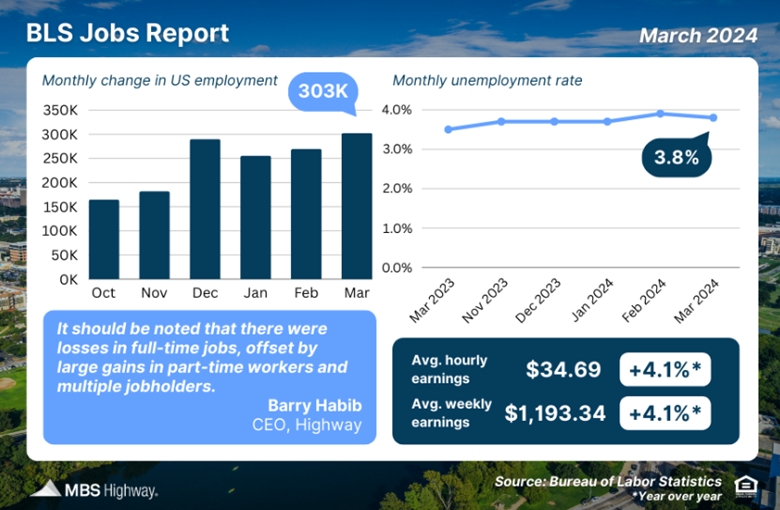

Recent job market data is a testament to strong economic momentum that can significantly influence the housing market in Wisconsin. In March, the economy added 303,000 new jobs, with revisions to prior months adding 22,000 more. The unemployment rate dipped to 3.8%, indicating more individuals and families gaining financial confidence to purchase homes. In Brookfield, WI, and across the state, this uptick in employment can increase housing demand. Job stability is particularly crucial for physicians and doctors, who often benefit from physician-specific loan programs aimed at facilitating homeownership.

Increased Buyer Competition

With a strong job market, more people will consider buying homes, increasing competition, particularly in desirable areas like Brookfield. This can drive up home prices, especially in regions with limited housing inventory. Multigenerational families and those recently divorced seeking new living arrangements should act swiftly as increased competition can elevate home prices further.

Navigating mortgage rates surpassing the 7% mark can be daunting for potential homebuyers. However, with a well-strategized approach, particularly in the Brookfield, WI, and greater Wisconsin area, this seemingly challenging market can present unique opportunities, especially for first-time buyers, physicians, doctors, those going through a divorce, and families looking into multigenerational housing.

Historical Perspective on Mortgage Rates

While current rates hovering around 7% might seem intimidating, understanding the historical context sheds light on the broader picture. In the early 1980s, mortgage rates soared to an eye-watering 18%, and even in more stable times, fluctuated above 10%. This historical perspective is crucial; it shows that today's rates, while higher than recent years, are within a historical norm. For first-time buyers and physicians in Brookfield, WI, understanding this context can help set realistic expectations and reduce anxiety over current rates.

Appreciation Trends in Real Estate

The real estate market's consistent appreciation trend is likely to continue, given ongoing supply constraints and robust demand. For first-time buyers and physicians considering homes in Brookfield, WI, delaying a purchase could mean facing higher prices later on. Additionally, the longer you stay in a home, the more you benefit from amortization, where a higher percentage of your payment goes towards principal reduction over time. Delaying a purchase not only risks higher prices but also postpones the financial benefits of paying down your mortgage.

Example Scenario: Imagine eyeing a $300,000 home in Brookfield today. With an average appreciation rate of 4% per year, the same home could cost about $312,000 next year. Waiting could mean paying $12,000 more and losing a year’s worth of amortization benefits.

Financial Drain of Renting

Continuing to rent while waiting for better economic conditions means each rent check is an investment in someone else’s financial future. Renting offers no ROI through home appreciation or loan amortization. For those navigating divorce or considering multigenerational living arrangements, purchasing a home sooner rather than later can build financial stability and wealth. If you think housing is hard, check out our FirstHome IQ Quiz here. But don't forget to read the rest of this below, too.

Strategies to Win in Today’s Housing Market

Fully Underwritten Pre-Approval: This strengthens your offer in a competitive market by showing sellers that your financials are thoroughly vetted. For doctors and first-time homebuyers, demonstrating preparedness can set you apart in Brookfield’s crowded market.

Convert to Cash with Luminate’s Power Buyer Program: Making a cash offer bypasses many financing hurdles, making your bid more attractive to sellers. This can be particularly beneficial for multigenerational families desiring swift transactions.

Exploring Grant Programs: Programs like those offered by the Michael Creed Team, powered by Luminate Home Loans, can cover up to 2% of your down payment, reducing upfront costs and facilitating easier entry into homeownership. This can be advantageous for first-time buyers and recently divorced individuals seeking to establish new residences.

Adopting a Strategic Mindset: The philosophy "marry the home, date the rate" encourages purchasing the right home now and refinancing if and when rates drop. This ensures you start building equity immediately and can take advantage of lower rates later. For physician loans and doctor loans, tailored mortgage solutions can further enhance this strategy.

Despite current headlines about soaring mortgage rates, it's essential to note that residential real estate prices have appreciated in 74 out of the last 82 years—a 90% increase. Home values tend to rise, despite periods of elevated mortgage rates.

Carefully review the chart below showing real estate prices in green versus prices declining in red. Despite previously high mortgage rates, home prices are much more likely to appreciate.

74 / 7 / 1 since 1942!

As Brookfield's mortgage rates rise, opportunities for temporary interest rate buydowns might become available. If you have any questions or need assistance, we're here to help!

Contact us today.

All Rights Reserved | Luminate Bank | NMLS#1281698 | Privacy Policy | Company Licenses | NMLS Consumer Access Mortgage Banking Products are not FDIC Insured