Download Center

Welcome to our Download Center, where we provide you with all the resources you need to make informed decisions about your loans. We understand that the loan process can be overwhelming at every turn, which is why we've created a range of downloadable guides that can help you understand your options and make the right choices.

We encourage you to take advantage of the free resources we've created to help you achieve your financial goals. We're here to support you every step of the way!

Selling Your Home

If you're thinking about selling your house, you may be wondering how mortgage rates could impact your move.

Buying a Home

There's no arguing this past year has been challenging for homebuyers. But the market is in a transition right now and that gives today's homebuyers key opportunities!

Homebuyers Guide

This mortgage process guide is designed to help experienced buyers, and new buyers alike, see an overview of the mortgage process from start to finish.

A Guide to Buying Your First Home

Don’t worry – no one expects you to know everything about the process up front. Instead, focus on your homebuying goal and how achieving it will change your life. Let the experts help you along the way with

the finer details.

Loan Options & Property Requirements

If you're selling your home soon, you should take a peek at the minimum property requirements for each type of loan. Each loan has its own unique benefits and guidelines.

Homework Due by Closing

One introductory group text to 262-696-9048 is all it takes to ensure those you know have the mortgage experience they deserve. We’ll take it from there.

Refinance for Life

Borrowers purchasing a home in a rising rate environment may be able to refinance with Michael Creed to a lower rate with no origination fee.

Getting Your Offer Accepted

Check out these 10 ways we are seeing buyers getting their offers accepted on the home of their dreams!

Winning in a Seller's Market

Feeling stuck as a buyer in a seller's market? We have a few tips that can help get you into your home.

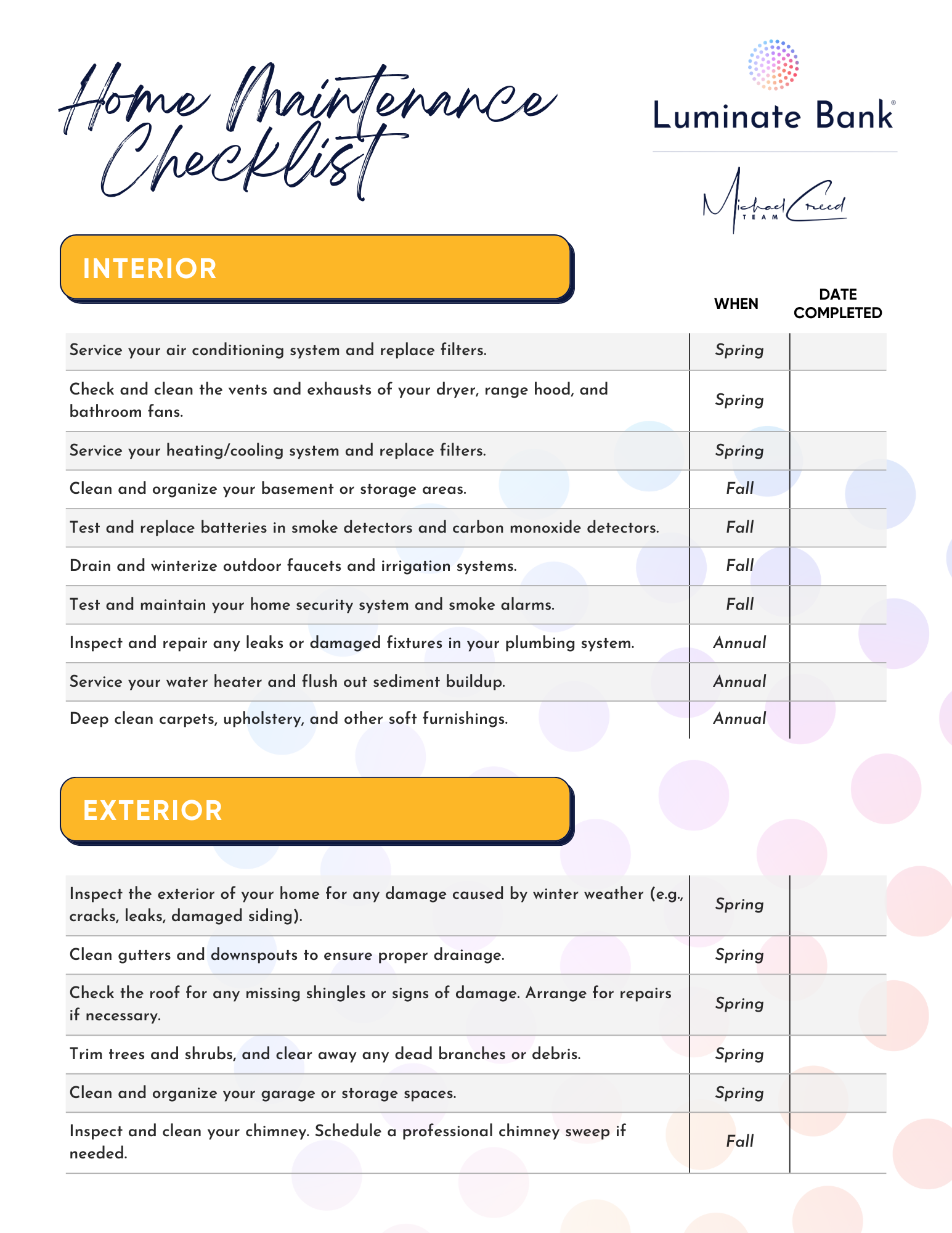

Home Maintenance Checklist

Whether you're a seasoned homeowner or a first-time buyer, this handy resource is designed to help you stay organized and proactive in maintaining your property.

Home Budgeting Made Simple

With an easy-to-use template and categories, you can easily monitor your spending, identify areas where you can cut back, and allocate funds wisely.

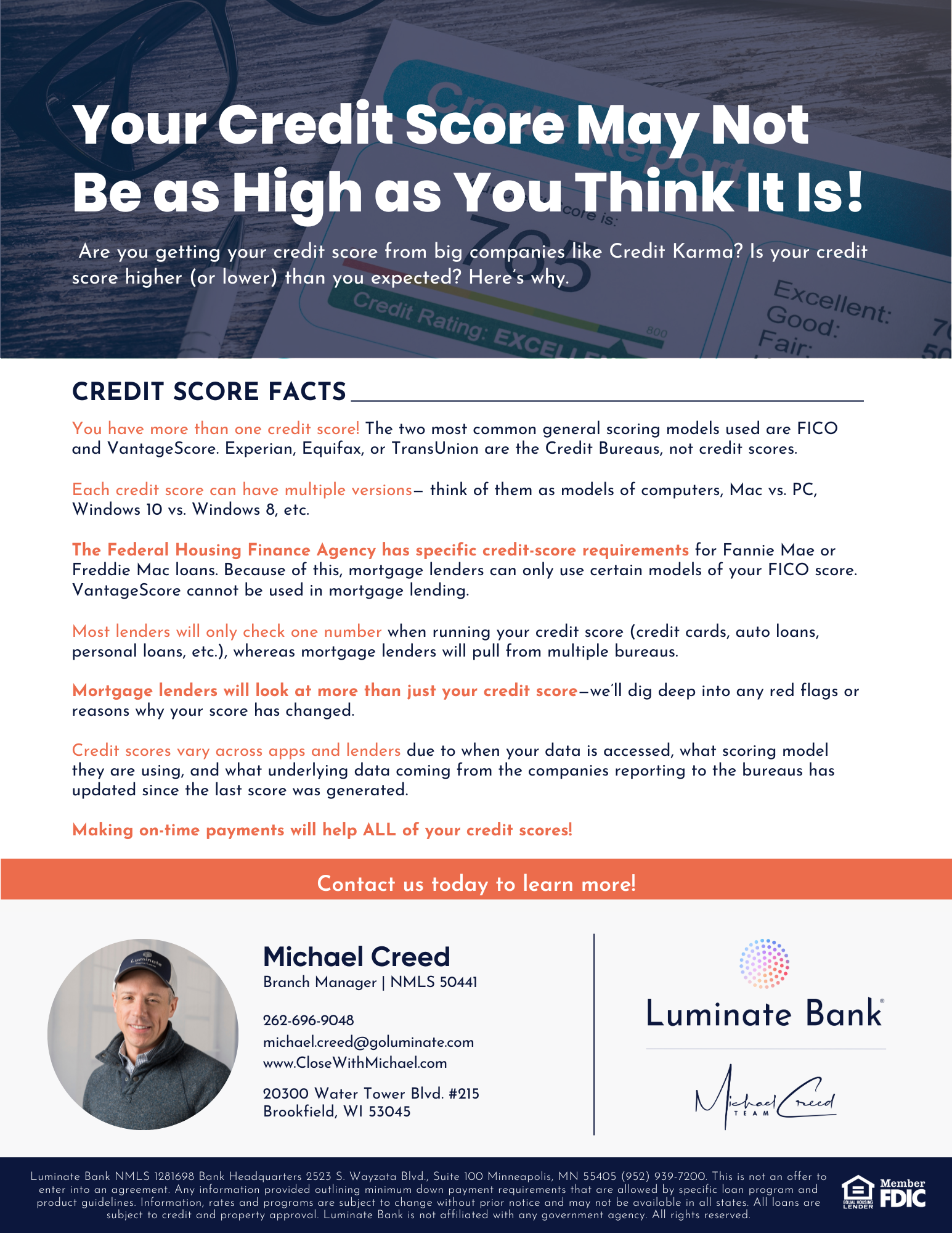

Your Credit Score May Not Be as High as You Think It Is!

Are you getting your credit score from big companies like Credit Karma? Is your credit score higher (or lower) than you expected? Here’s why.

All Rights Reserved | Luminate Bank | NMLS#1281698 | Privacy Policy | Company Licenses | NMLS Consumer Access Mortgage Banking Products are not FDIC Insured