Downsizing for Dreams Doesn’t Have to Mean Settling

Welcome to a new era in home buying, where downsizing isn't about settling; it's all about smart choices that align with your budget and lifestyle. The housing market is seeing a significant shift as builders pivot towards constructing smaller, more affordable homes. This trend is transforming the landscape of home buying, making it accessible for first-time buyers, sustainable living enthusiasts, and urban dwellers alike. In this blog post, we’ll explore why this trend is gaining momentum, how it benefits you, and why now is the perfect time to explore these opportunities.

Why Builders are Rethinking Home Size

The last few years have seen a profound shift in buyer preferences and market conditions. During the pandemic, the demand for larger homes surged as people sought extra space for home offices, gyms, and multifunctional rooms. Builders responded swiftly, catering to these needs by constructing bigger homes. But as we move past those times, the economic landscape has changed.

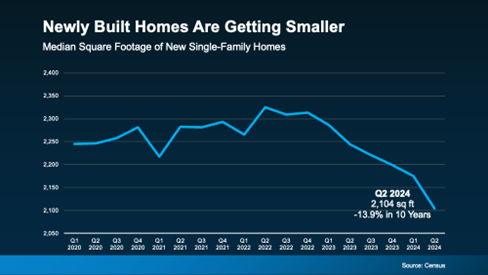

With affordability now at the forefront of buyers' minds, a new trend has emerged. Builders are focusing on creating homes that are both smaller and more cost-effective. According to the National Association of Home Builders (NAHB), today’s buyers are seeking homes around 2,070 square feet, a noticeable reduction from the 2,260 square feet they desired two decades ago. Builders recognize that smaller homes often equate to smaller price tags, making them a smart choice for budget-conscious buyers. Orphe Divounguy, a senior economist at Zillow aptly notes,

“Builders are adjusting the type and size of homes to meet the need for more affordable options.”

The Financial Perks of Smaller, New Builds

Purchasing a newly constructed home comes with a host of benefits, particularly when it comes to your finances. Builders are not only offering homes with reduced square footage but are also throwing in attractive incentives to sweeten the deal. These can include price reductions or mortgage rate buy-downs, which directly impact your monthly payments by lowering them significantly.

Insights from Zonda reveal that over half of builders are implementing such incentives to make new homes even more appealing. John Burns of John Burns Research & Consulting highlights that builders understand the importance of monthly affordability, leading them to create smaller, efficient home designs. For buyers, this means having access to modern, brand-new properties that require minimal maintenance and come equipped with the latest energy-efficient technology—features that promise long-term savings.

New Home Construction and Sustainability

In addition to financial benefits, newly built smaller homes offer advantages in sustainability. These homes are typically designed with eco-friendly materials and energy-saving systems that appeal to those keen on reducing their carbon footprint. Modern construction practices ensure that these homes are not just cost-effective but also environmentally responsible.

Additionally, incorporating green technology such as solar panels, smart thermostats, and water-efficient fixtures can significantly reduce energy bills. By choosing a new, smaller home, buyers can enjoy the dual advantages of cost savings and contributing to a healthier planet.

Location, Location, Location

Smaller homes are often situated in prime locations, providing proximity to the conveniences of urban living without the hefty price tag of larger city properties. For urban dwellers, this means access to cultural attractions, dining, shopping, and public transportation—benefits that enhance lifestyle quality and save time.

These developments are strategically placed to offer residents a blend of comfort, connectivity, and community. For individuals and families who value the vibrancy of city life, smaller homes present an ideal solution that doesn’t compromise on location and convenience.

Community Appeal and Lifestyle Changes

The trend towards smaller homes is also fostering a stronger sense of community. With less emphasis on expansive private spaces, residents find themselves engaging more with their surroundings and neighbors. This shift encourages a lifestyle that balances private and communal living, promoting social connections.

Many new developments include shared spaces such as parks, community gardens, and recreational areas, enhancing the overall living experience. For those who prioritize community and social interaction, smaller homes offer an inviting environment where connections flourish.

Navigating the Modern Real Estate Market

Navigating today’s real estate market requires staying informed and adaptable. With builders focusing on smaller homes, potential buyers have more opportunities to find properties that align with their financial goals and lifestyle preferences. Engaging with a knowledgeable realtor or real estate agent who understands these trends can be invaluable.

Real estate professionals can provide insights into the best developments featuring smaller homes, inform you about exclusive deals, and assist in securing the most favorable terms. They play a crucial role in bridging the gap between buyers and the evolving housing landscape.

Addressing Buyer Concerns

For some, the idea of moving into a smaller home might spark concerns about space limitations or future needs. However, it’s important to consider the long-term benefits such as financial freedom, reduced maintenance, and adaptability. Smaller homes often come with clever design solutions that maximize space and functionality.

Additionally, owning a smaller home can provide flexibility for life changes, such as relocating for work or expanding your family. These homes often serve as a stepping stone to building equity that supports future moves or investments.

Making the Most of Your New Space

Transitioning to a smaller home offers the chance to reassess possessions and focus on what truly matters. This lifestyle change promotes minimalism, encouraging homeowners to prioritize quality over quantity in their belongings.

Investing in multifunctional furniture, optimizing storage solutions, and utilizing vertical spaces can transform a small home into a comfortable and efficient living space. The trend towards smaller homes inspires creativity and intentional living, allowing homeowners to craft spaces that reflect their personal style.

A New Chapter in Homeownership

For many first-time homebuyers and urban dwellers, the shift towards smaller homes represents an exciting new chapter in homeownership. It aligns with current trends in sustainable living, financial prudence, and community engagement. The evolution of the housing market presents opportunities to explore innovative living solutions that cater to modern needs.

By exploring the new wave of smaller homes, potential buyers can find properties that offer the perfect balance of affordability, convenience, and lifestyle benefits. Engaging with these trends opens the door to a promising future in real estate.

Wrapping Up

In conclusion, the latest trend in the housing market reveals a promising shift towards smaller, more affordable homes. Builders are responding to the call for financial accessibility and sustainability, offering new construction that meets modern demands. For first-time buyers, sustainable living enthusiasts, and urban dwellers, this trend heralds a wealth of opportunities to explore.

If you’re considering buying a home that fits your budget and lifestyle, now is the time to act.

Connect with us to learn more about the available options in your preferred area and take the first step towards achieving your homeownership dreams.

All Rights Reserved | Luminate Bank | NMLS#1281698 | Privacy Policy | Company Licenses | NMLS Consumer Access Mortgage Banking Products are not FDIC Insured