Finding Your Ideal Mortgage Rate in 2024: What Number Are You Waiting For?

The mortgage market can feel like uncharted territory, especially for first-time homebuyers and real estate investors. But with mortgage rates starting to decline, now might be the perfect time to explore your options. The question is, what mortgage rate are you waiting for before making your move?

In this blog post, we’ll break down the current economic landscape, expert predictions, and how you can determine the right rate for your home-buying journey.

Understanding the Current Economic Situation

The Federal Reserve has been instrumental in managing inflation and stabilizing the economy, particularly after the disruptions caused by the COVID-19 pandemic. According to Fed Chair Jerome Powell, the most severe economic distortions from the pandemic are receding, leading to a noticeable decline in inflation. This reduction has had a direct impact on mortgage rates, which have started to fall. Powell expressed confidence that inflation is on a steady path back to the Fed’s 2% target, a significant factor in the recent drop in mortgage rates.

What Are Experts Predicting for Mortgage Rates?

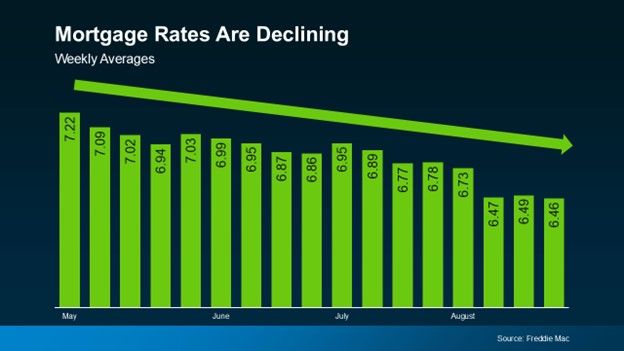

Economic experts generally agree that as inflation continues to ease, mortgage rates are likely to follow a downward trend. However, this doesn't mean rates will decrease in a straight line—there will likely be some fluctuations as new economic data emerges. Despite these short-term variations, the overall outlook is promising. Compared to the peak rates seen earlier this year, we've already experienced a decline of about one percentage point.

For example, Realtor.com recently revised its mortgage rate forecast for 2024, predicting that rates could average around 6.7% for the year and potentially dip to 6.3% by year’s end. This optimistic projection is based on the expectation that the Federal Reserve will begin to ease its restrictive monetary policies as inflation becomes more manageable.

What’s Your Target Rate?

As rates continue trending downward, it's essential to consider what rate would make you comfortable to start your home search. Whether it’s 6.5%, 6.0%, or even lower, the rate you choose should align with your financial situation and long-term goals. Here are some key questions to help you identify your target rate:

- What monthly payment can I comfortably afford?

- How much of a down payment am I planning to make?

- How long do I plan to stay in the home?

- What impact will different interest rates have on my overall budget?

- How much have home prices in my desired area changed recently?

- Am I prepared to act quickly if rates hit my target?

Answering these questions can help you determine a rate that makes sense for your budget and future plans.

Why Waiting Could Cost You

While it might be tempting to wait for rates to drop even further, it’s important to consider what that could cost you. For every 1% drop in mortgage rates, approximately 5 million more households become eligible to buy a home. This increase in competition could lead to multiple offers on the homes you’re interested in, making it harder to secure your dream home.

Additionally, the perfect home might not be on the market forever. If you wait too long, you might miss out on your ideal property because someone else was ready to act when rates hit their target.

How to Stay Prepared

Once you've established your target rate, you don't need to monitor rates daily. Instead, consider partnering with a trusted mortgage professional who can keep an eye on the market for you. They can notify you when rates reach your desired level, ensuring that you're ready to act when the opportunity arises.

At Luminate, we also monitor the rate environment for refinancing opportunities, so you can take advantage of a lower rate later if they continue to drop. Our philosophy? Date the rate, marry the house. By securing your dream home now, you can always refinance to a better rate when the opportunity arises.

Understanding Your Financial Situation

Before you lock in a mortgage rate, it's crucial to understand your financial situation fully. This includes knowing your credit score, understanding your debt-to-income ratio, and having a clear picture of your monthly expenses. A good credit score can significantly impact the rate you qualify for, so it's worth taking steps to improve it if necessary.

Exploring Different Mortgage Options

There are various mortgage options available, each with its own set of terms and conditions. Fixed-rate mortgages offer stability with a consistent interest rate, while adjustable-rate mortgages (ARMs) can provide initial lower rates that adjust over time. Understanding the pros and cons of each type can help you make a more informed decision.

The Role of Down Payments

The size of your down payment can also affect your mortgage rate. A larger down payment often results in a lower interest rate and can help you avoid private mortgage insurance (PMI). It's essential to weigh the benefits of a larger down payment against other financial priorities you may have.

Navigating the Housing Market

The housing market can be unpredictable, with prices varying widely depending on location and demand. Staying informed about market trends in your desired area can help you make a more strategic decision when it comes to purchasing a home. Websites like Realtor.com offer valuable insights into market conditions and property values, however it's important to connect with a licensed real estate agent to be sure that the information you are seeing on websites like Realtor.com or Zillow.com is up-to-date and accurate to the MLS.

The Importance of Pre-Approval

Getting pre-approved for a mortgage can give you a competitive edge in the home-buying process. Pre-approval not only shows sellers that you are a serious buyer but also helps you set a realistic budget for your home search.

Leveraging Technology in Home Buying

Technology has made the home-buying process more accessible and efficient. Online mortgage calculators, virtual home tours, and digital document signing are just a few tools that can streamline your experience. Make sure to leverage these resources to save time and make more informed decisions.

Building a Relationship with Your Lender

Establishing a strong relationship with your lender can be beneficial in the long run. A trusted mortgage advisor can offer personalized advice, keep you informed about market changes, and guide you through the complexities of the mortgage process.

Conclusion

If you've been holding off on purchasing a home due to higher mortgage rates, now is an opportune time to reassess your plans. Remember – just a 1% drop in rates could bring millions of new buyers into the market, increasing competition and making it harder to find and secure your ideal home.

Talk to your lender about setting a target rate that aligns with your financial goals, and work closely with them to stay informed. By being proactive and setting a clear target, you'll be better positioned to take advantage of favorable market conditions and make a confident, informed decision when the time is right.

When you're ready, we're ready—reach out to us if you have any questions. And remember, with our “Buy Now, Sell Later” program, we can help you navigate your home-buying journey with confidence.

All Rights Reserved | Luminate Bank | NMLS#1281698 | Privacy Policy | Company Licenses | NMLS Consumer Access Mortgage Banking Products are not FDIC Insured