Unlocking the Power of Cash Purchases with The Michael Creed Team at Luminate Home Loans in 2024

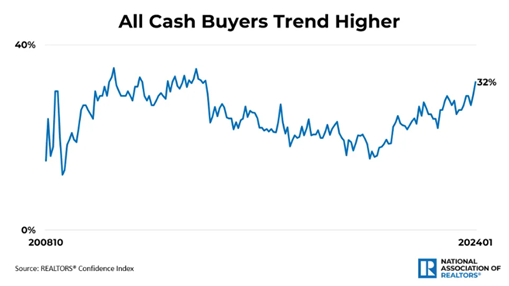

The 2024 real estate market is challenging, to say the least. Battling against multiple bids, the emotional toll, and the pressure from competing offers can be quite disheartening. Remarkably, 32% of home sales are now being secured by buyers who pay in full with cash, highlighting the significant advantage that comes with having liquid assets at your disposal.

This trend towards cash purchases highlights a market dynamic where speed and reliability are paramount, particularly as home prices rise amidst a limited supply of properties. In this environment, it's wise to explore every available option to facilitate the sale of your current property and ensure the acceptance of your offer on a new home.

Exploring Alternatives

iBuyers: These companies provide a fast, no-fuss selling experience for homeowners eager to avoid the conventional market. By offering instant cash proposals, iBuyers attract those looking for quick transactions and convenience. However, this convenience often comes with a price in the form of service charges and, possibly, lower bid prices since iBuyers prioritize expedience over securing the highest possible price for the seller.

Power Buyers: These programs are designed for homeowners who wish to buy their next property before selling their existing one. They typically utilize financial mechanisms like bridge loans to bridge the gap between purchasing and selling, providing a solution to the timing discrepancies between these two activities. Though this method introduces a greater degree of flexibility, it also complicates the transaction and may incur additional costs.

It's crucial to recognize that not all iBuyer and Power Buyer offerings are created equal. The key lies in discovering a program that aligns with your unique needs.

The Michael Creed Team at Luminate Home Loans' Distinct Approach

With the Michael Creed Team at Luminate Home Loans, we've distinguished ourselves within the marketplace. Our tailored program transforms our clients into cash purchasers – a critical distinction, not merely an added benefit. Being a cash buyer elevates the attractiveness of your offer to sellers, bypassing the common hold-ups associated with securing loan approvals.

Our strategy is intentionally designed with the homeowner in mind. We afford you the immediate leverage of a cash proposal, along with the liberty to select the most suitable financing route for your circumstances later on. Our aim is to empower you with both control and confidence throughout your home acquisition process.

If you're dealing with the intricacies of both buying and selling residences, our unique program could be exactly what you need. We're committed to ensuring our processes are transparent, your personal information is safeguarded, and your transition into your new home is seamless.

Choosing the Michael Creed Team at Luminate Home Loans means you're not just changing your address. You're engaging with a meticulously structured system designed to place you in your ideal home smoothly and securely. Should this resonate with your needs, we're prepared to make it a reality.

© 2024 All Rights Reserved | Luminate Home Loans, Inc.

Privacy Policy |

Company Licenses |

NMLS Consumer Access NMLS# 150953